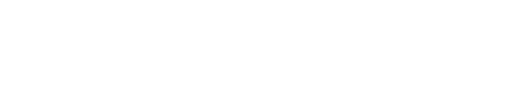

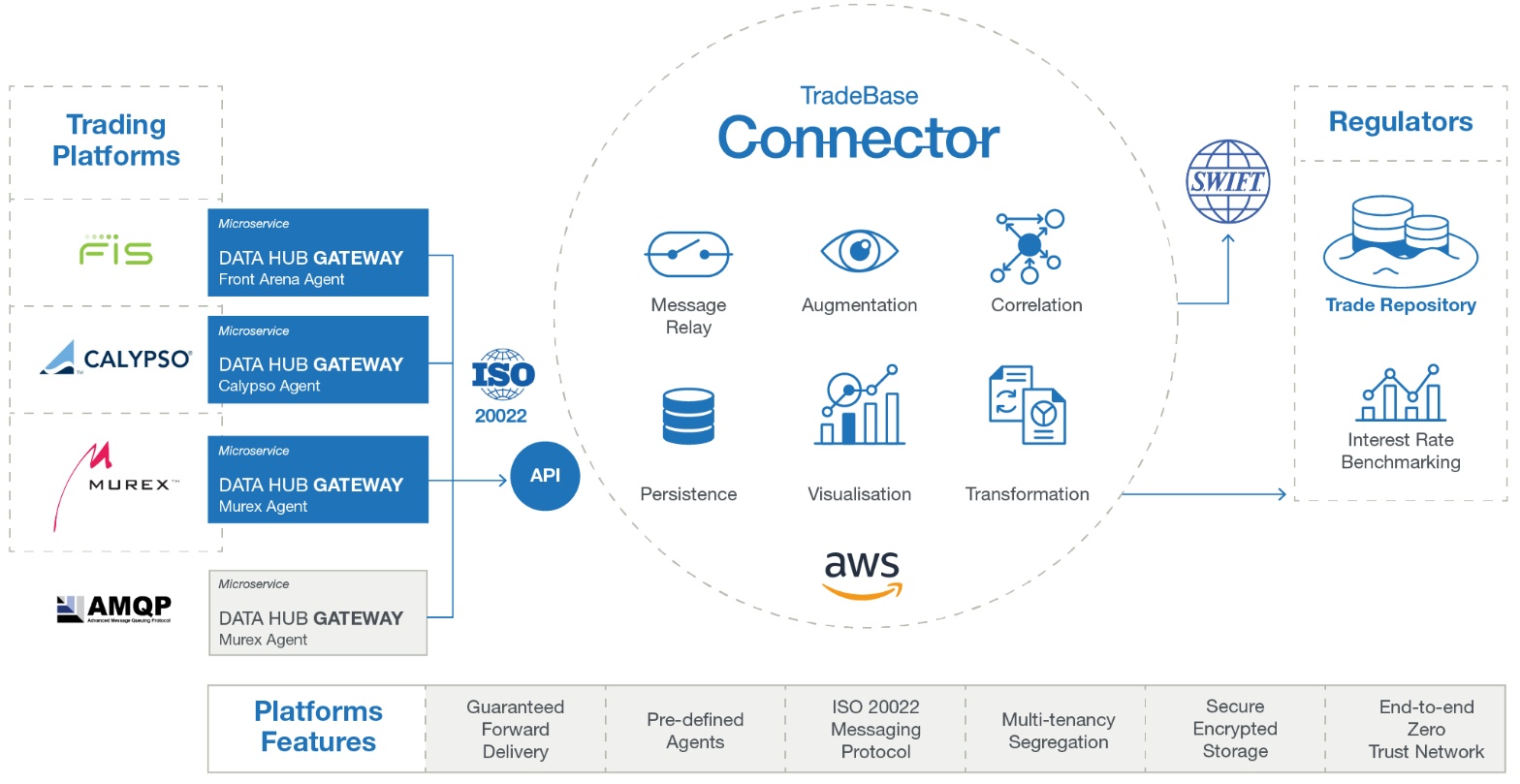

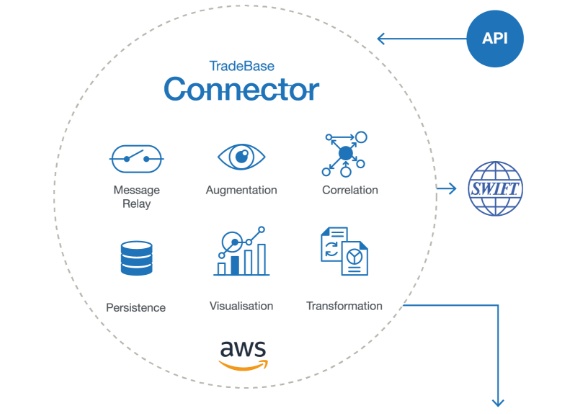

The pressure to stay compliant has been amplified in recent years by the rate of regulatory change. Ensuring that your systems work together to streamline business processes is key to meeting the needs of the bank. Our Tradebase Connector solution establishes communication between your treasury systems and the outside world: regulators, clearing houses, trade repositories, and market platforms.

Tradebase Connector use cloud computing technology through a Software-as-a-Service model allowing banks regulatory monitoring, reporting and compliance. Tradebase Connector supports connectivity between all major financial and capital market vendor platforms and several Central Bank integration points. We give our clients full visibility of the information flow between platforms through TradeBase Connector’s easy-to-use monitoring platform.

Benefits

Streamline your business

Focus on the essential core-services of your business, utilising our specialist team to execute, thereby conserving and better deploying your own scarce resources.

Speed to Market

Our experience means that we are efficient and quick, lowering your product delivery costs and ensuring a faster time to market.

Standard Interfaces

Our standard interfaces in Capital Markets Trade and Treasury are microservices oriented which means that we are able to expand to meet the immediate needs of the bank.

A fully hosted and managed cloud solution

As IT delivery becomes more efficient, our Cloud Solutions enable better stability, scalability, and cost control. We help you develop cloud-native applications, which mitigate existing cyber security risks and respond to new threats quickly.

What clients say about our service

Millen Mehari

Joseph Mpholo

Neil Mackenzie

Other Transform the Bank Offerings

Other Service Lines

Centres

of Excellence

Servicing the top global Trade and Treasury vendor systems used by our global Banking clients…

Run

the bank

Services to help Banks run their Trade and Treasury units more effectively and reduce TCO.